ArabPay & the Diaspora Economy

A Unified Digital Framework for Outbound and Inbound Workforce Flows

The Problem

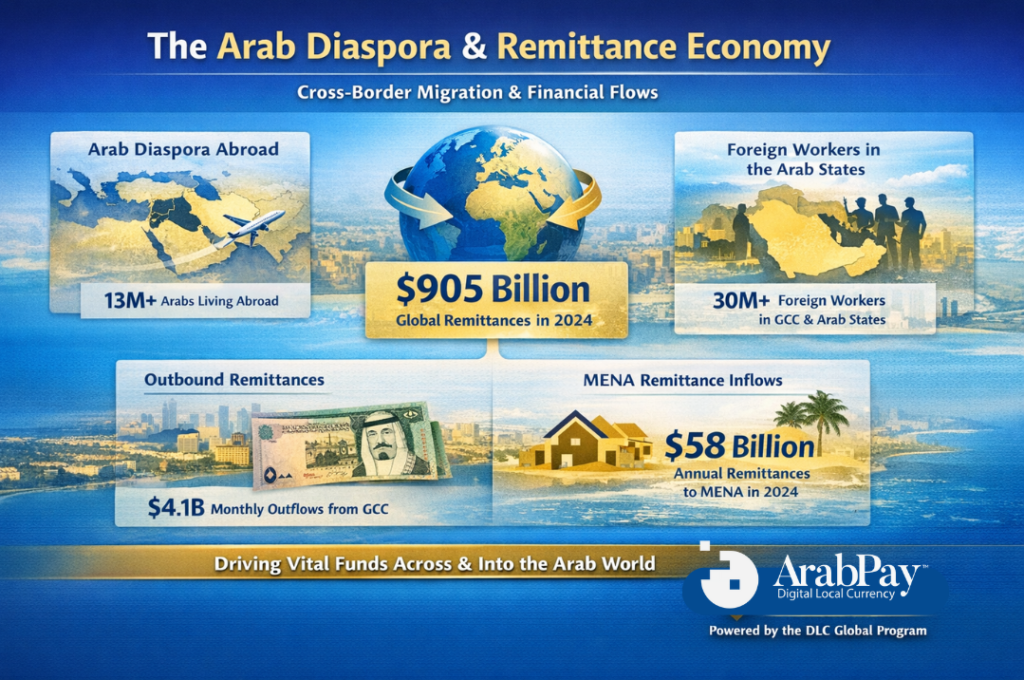

For decades, diaspora populations have stood at the center of fragmented financial systems.

Arab citizens working abroad often face high remittance costs, limited access to home-country financial services, and weak regulatory oversight around income inflows.

Non-Arab diaspora working across the Arab region—including millions from Asia and Africa—frequently deal with wage protection frameworks (e.g., WPS), limited access to fair digital tools, and a reliance on costly informal channels to send money home.

At the regulatory level, both sending and receiving countries seek transparency, compliance, and value retention—but commercial banks and e-money companies have largely deprioritized diaspora users due to low profit margins and regulatory complexity.

This has created an ecosystem where the people who move economies the most remain the least supported.

World Tourism Numbers

Türkiye ranks among the liked of France, Spain, and the United States of America when it comes to tourists they receive every year. Chances are many of your clients book their Türkiye trip through you. So, next time, offer them a revolutionary set of tools that helps them have a much better stay. Payment is always a worry tourists have as our payments systems have something similar to a language barrier, which persists. TürkiyePay breaks through that barrier by leveraging global and local players to smooth out the experience of the end-user.

How ArabPay Solves This,

Powered by the DLC Global Program

ArabPay, as the regional arm of the Digital Local Currency (DLC) Global Program, offers a government-aligned, fully regulated infrastructure that brings together central banks, financial institutions, and regulators from both origin and destination countries to transform the way diaspora populations engage with local currencies.

✅ 1. For Arab Diaspora Working Abroad

Home-country banks can join the DLC network, receive bulk allocations of foreign digital currency, and distribute it digitally to their own citizens working overseas.

Diaspora users abroad can access home-country wallets, hold local currency digitally, and BUY, KEEP, and SPEND in a compliant, low-cost way.

Foreign earnings are made visible to regulators while offering diaspora users a dignified, bank-grade alternative to remittance apps and cash-based transfers.

✅ 2. For Non-Arab Diaspora Working in Arab Countries

ArabPay allows foreign banks (e.g., from India, Pakistan, Philippines, Nigeria, etc.) to open correspondent accounts with Arab DLC partner banks—no local license or branch needed.

These banks can secure bulk allocations of Arab digital currency and disburse wages to their own citizens digitally, while remaining aligned with wage protection frameworks.

Workers receive fair pay, stored safely in digital wallets, and can spend locally or convert digitally for remittance—fully compliant, low-risk, and cash-free.